Business

Google CEO Warns of AI Stock Market Bubble Risks

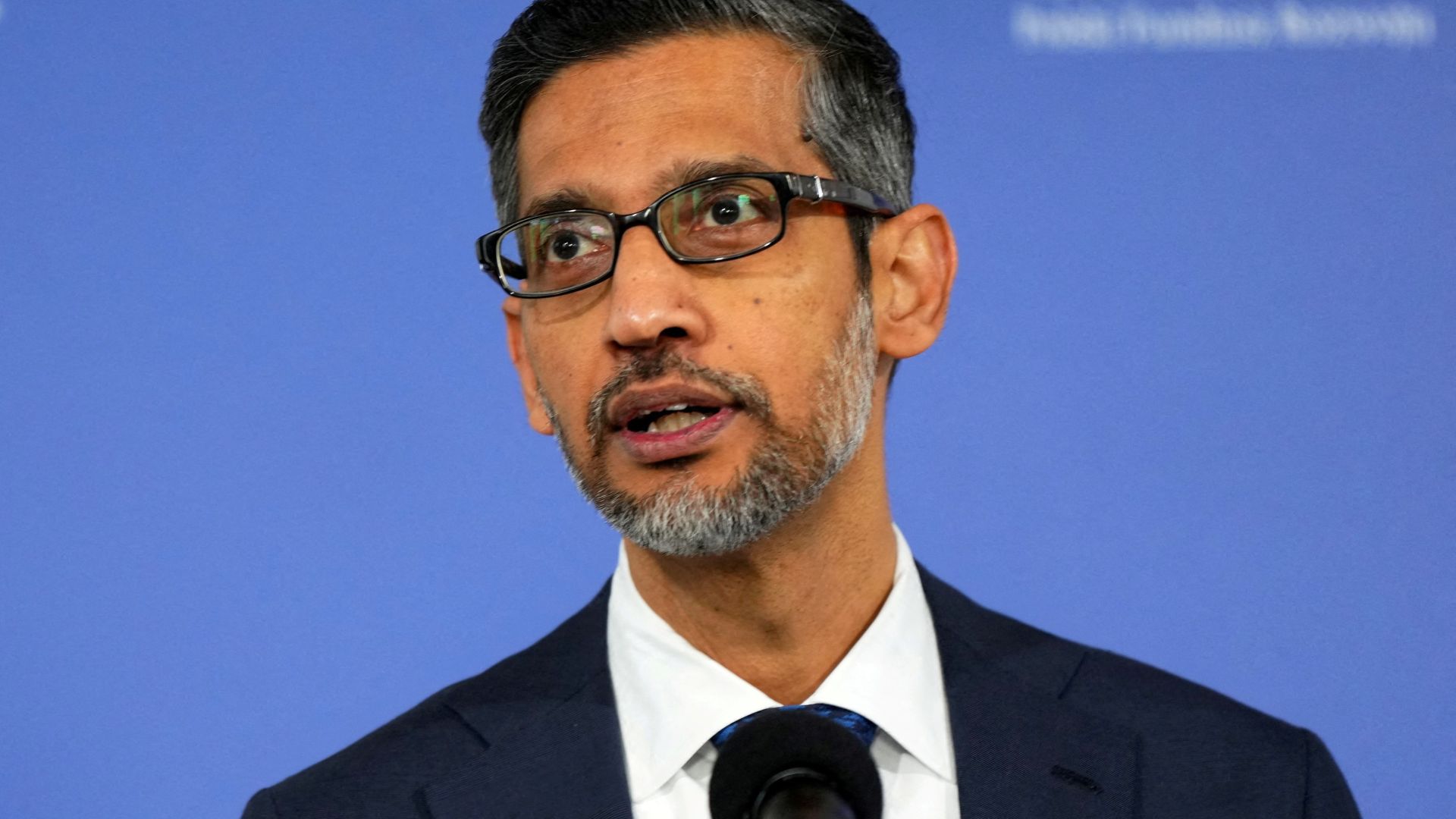

Sundar Pichai, the CEO of Google, has issued a stark warning regarding the potential risks associated with the rapidly rising stock prices of companies involved in artificial intelligence (AI). He stated that “no company would be immune” if a bubble were to burst in the AI sector. Pichai’s comments reflect growing concerns about the sustainability of current stock valuations, reminiscent of the **2000 dot-com crash**.

Pichai highlighted an underlying “irrationality” in the stock price increases witnessed across hundreds of AI-related firms. The surge in valuations has been driven by heightened investor interest and optimism surrounding AI technologies, but this growth raises questions about its long-term viability.

Concerns Over Valuation and Market Stability

The AI market has seen remarkable investments, with numerous startups and established companies alike experiencing soaring stock prices. These developments have led to speculation that the industry may be facing a valuation bubble akin to the dot-com era, where many companies saw their stock prices plummet after an initial surge.

Pichai’s remarks come at a time when market analysts are closely monitoring the tech sector for signs of a correction. The **dot-com crash** serves as a cautionary tale, where excessive speculation led to significant financial losses for investors. As Pichai noted, the current market dynamics could lead to similar outcomes if the enthusiasm surrounding AI technologies does not align with their actual performance and profitability.

Investor sentiment remains mixed, with some experts advocating for a cautious approach. They emphasize the importance of scrutinizing the fundamentals of companies in the AI space rather than relying solely on hype.

The Future of AI Investment

Looking ahead, Pichai underscored the necessity for companies to remain grounded in reality as they navigate the evolving landscape of AI. While the potential for innovation and growth is substantial, the risks associated with speculative investments cannot be ignored.

Investors are advised to remain vigilant and conduct thorough research before committing to AI-related stocks. As the market continues to evolve, the hope is that investors will prioritize sustainable growth over short-term gains, ensuring a more stable future for the industry.

As AI technologies continue to advance, the coming months may reveal whether the current optimism is justified or if the industry will face a correction reminiscent of past market bubbles.

-

Entertainment2 months ago

Entertainment2 months agoIconic 90s TV Show House Hits Market for £1.1 Million

-

Lifestyle4 months ago

Lifestyle4 months agoMilk Bank Urges Mothers to Donate for Premature Babies’ Health

-

Sports3 months ago

Sports3 months agoAlessia Russo Signs Long-Term Deal with Arsenal Ahead of WSL Season

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Flock to Discounted Neck Pillow on Amazon for Travel Comfort

-

Politics4 months ago

Politics4 months agoMuseums Body Critiques EHRC Proposals on Gender Facilities

-

Business4 months ago

Business4 months agoTrump Visits Europe: Business, Politics, or Leisure?

-

Lifestyle4 months ago

Lifestyle4 months agoJapanese Teen Sorato Shimizu Breaks U18 100m Record in 10 Seconds

-

Politics4 months ago

Politics4 months agoCouple Shares Inspiring Love Story Defying Height Stereotypes

-

World4 months ago

World4 months agoAnglian Water Raises Concerns Over Proposed AI Data Centre

-

Sports4 months ago

Sports4 months agoBournemouth Dominates Everton with 3-0 Victory in Premier League Summer Series

-

World4 months ago

World4 months agoWreckage of Missing Russian Passenger Plane Discovered in Flames

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Rave About Roman’s £42 Midi Dress, Calling It ‘Elegant’