Politics

Oregon Tax Hike Reversal Gains Momentum with Signature Submission

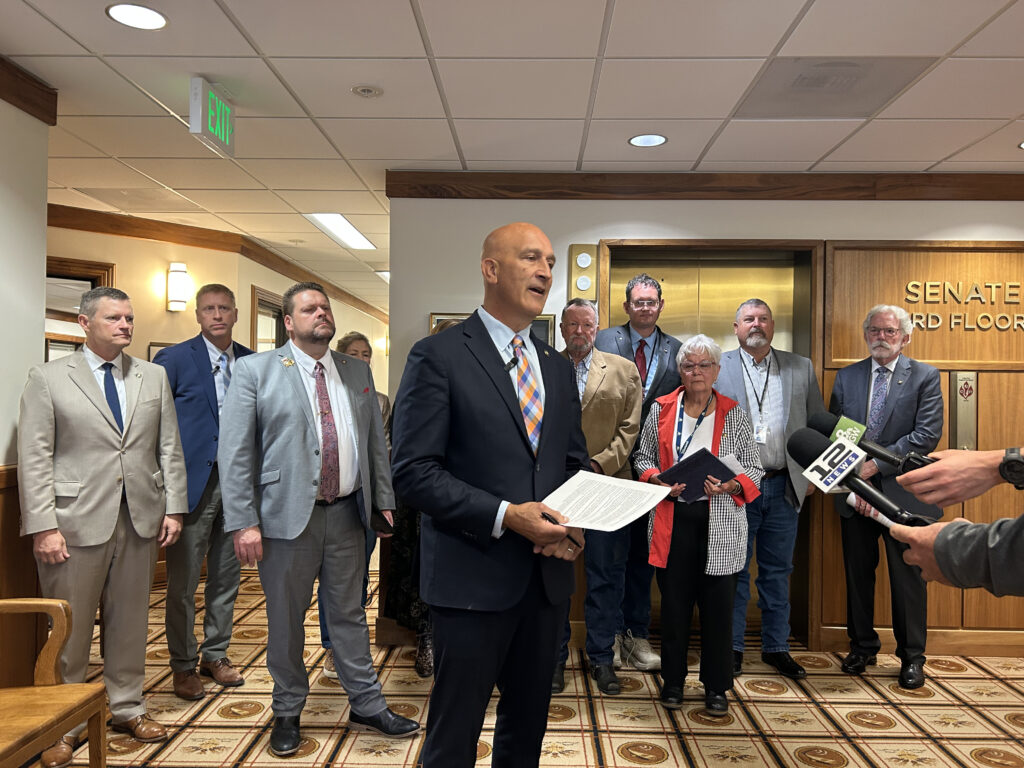

Opponents of a controversial tax increase in Oregon are poised to make a significant impact as they prepare to submit nearly 200,000 signatures to state elections officials in Salem. This move is a response to recent hikes in the gas tax, vehicle registration fees, and a transit-oriented payroll tax, which are now on hold pending further review. The Republican-led campaign, known as No Tax Oregon, has gathered more than double the approximately 78,000 signatures required to refer the tax increases to the ballot in November 2026.

The submission is set to take place in a symbolic manner, with plans for a horse-drawn carriage to deliver the signatures. This act signifies a strong rejection of the tax measures approved by Democratic lawmakers in late September. The rapid collection of signatures was accomplished by a dedicated team of volunteers operating on a limited budget, demonstrating the campaign’s grassroots support. State elections officials now have until January 29, 2026, to verify the signatures and determine the petition’s validity.

The situation presents a challenge for elected Democrats, particularly for Gov. Tina Kotek, who advocated for these taxes to address what she described as looming layoffs and service cuts at the Oregon Department of Transportation (ODOT). The tax revenues were intended to mitigate a funding shortfall that has been exacerbated by workforce reductions, with nearly 300 ODOT employees leaving their positions from July to early December.

While the governor has emphasized the necessity of these taxes, the successful signature submission means that they will be suspended until Oregonians can vote on the matter. This raises questions about how Kotek and other Democratic leaders will navigate the financial implications. ODOT’s current funding shortfall remains unresolved, and the agency has over 600 vacant full-time positions, making the prospect of significant layoffs less likely, according to Senate Minority Leader Bruce Starr, a key figure in the No Tax Oregon effort.

Kotek’s office acknowledged the financial challenges ahead, stating that “cuts to crucial transportation programs are financially unavoidable.” Nonetheless, the administration aims to minimize the immediate impact on services, particularly for vulnerable communities that rely on public transit. The governor has instructed ODOT to continue hiring winter road crews while the situation evolves.

The tax increases stem from House Bill 3991, which was passed during a special legislative session. This legislation proposed a range of revenue-generating measures, including a 6-cent increase in the state’s gas tax, a temporary doubling of the payroll tax for public transit, and significant increases in vehicle registration and titling fees. If the signature petition qualifies, these changes will be postponed until voters have their say in November 2026.

While some elements of House Bill 3991 will proceed as intended—such as adjustments to heavy truck taxation and provisions for greater legislative oversight of ODOT—other aspects are now under scrutiny. The possibility of a complete repeal of the bill has emerged as a topic of discussion ahead of the upcoming legislative session in February. Some lawmakers caution against scrapping the entire bill, given the political ramifications and the support from various interest groups for certain provisions that remain intact.

As Oregon navigates this complex political landscape, the outcome of the signature verification process and the subsequent voter referendum will play a critical role in shaping the state’s transportation funding and the future of its public services.

-

Entertainment3 months ago

Entertainment3 months agoIconic 90s TV Show House Hits Market for £1.1 Million

-

Lifestyle5 months ago

Lifestyle5 months agoMilk Bank Urges Mothers to Donate for Premature Babies’ Health

-

Sports3 months ago

Sports3 months agoAlessia Russo Signs Long-Term Deal with Arsenal Ahead of WSL Season

-

Lifestyle5 months ago

Lifestyle5 months agoShoppers Flock to Discounted Neck Pillow on Amazon for Travel Comfort

-

Politics5 months ago

Politics5 months agoMuseums Body Critiques EHRC Proposals on Gender Facilities

-

Business5 months ago

Business5 months agoTrump Visits Europe: Business, Politics, or Leisure?

-

Lifestyle5 months ago

Lifestyle5 months agoJapanese Teen Sorato Shimizu Breaks U18 100m Record in 10 Seconds

-

Politics4 months ago

Politics4 months agoCouple Shares Inspiring Love Story Defying Height Stereotypes

-

World5 months ago

World5 months agoAnglian Water Raises Concerns Over Proposed AI Data Centre

-

Sports4 months ago

Sports4 months agoNathan Cleary’s Family Celebrates Engagement Amid Romance Rumors

-

Sports5 months ago

Sports5 months agoBournemouth Dominates Everton with 3-0 Victory in Premier League Summer Series

-

World5 months ago

World5 months agoWreckage of Missing Russian Passenger Plane Discovered in Flames