Top Stories

Moniepoint Raises $200 Million to Fuel Expansion Across Africa and Europe

Moniepoint, a fintech unicorn based in Nigeria, has successfully raised over $200 million in a Series C funding round aimed at expanding its services across Africa and Europe. This investment comes as the company seeks to enhance financial inclusion for small and medium-sized enterprises (MSMEs), which often struggle to access affordable financial services. Traditional banks frequently overlook these businesses due to stringent requirements for collateral and credit histories, which many MSMEs, particularly those operating informally, cannot meet.

The recent funding round was led by Development Partners International through its African Development Partners III fund. Notable participants included Google’s Africa Investment Fund, Visa, LeapFrog Investments, and the International Finance Corporation (IFC). A diverse group of additional investors contributed to the round, such as Lightrock, Alder Tree Investments, Proparco, Swedfund, Verod Capital Management, QED Investors, Novastar Ventures, FMO, British International Investment, Global Ventures, Endeavor Catalyst, and the New Voices Fund.

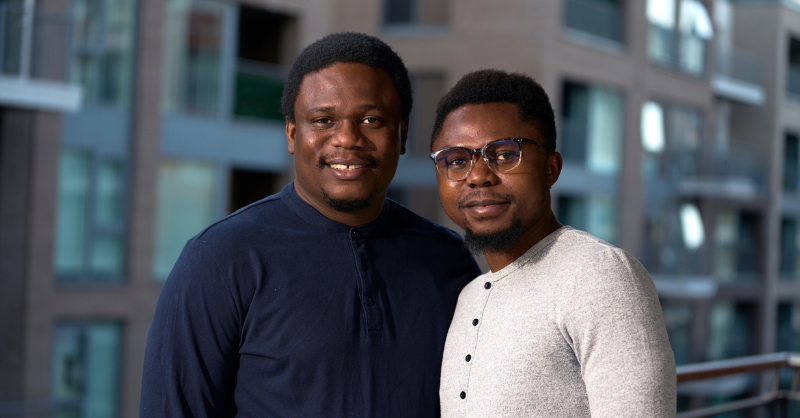

Founded in 2015 by Tosin Eniolorunda and Felix Ike, Moniepoint was established with a mission to improve financial services for African entrepreneurs. Leveraging their expertise in payments infrastructure, the founders have developed a digital platform that integrates payments, banking, credit, and business management tools. This enables MSMEs to effectively manage their transactions, grow their operations, and create job opportunities.

Moniepoint currently processes over $250 billion in transactions annually, serving more than 10 million active customers. The company distinguishes itself from competitors like Flutterwave, Paystack (owned by Stripe), TymeBank, and Chipper Cash by achieving profitability while maintaining a unicorn valuation. Its focus on sustainable growth, strong customer relationships, and a diverse range of products has allowed it to cater effectively to underbanked segments.

Strategic Expansion Plans and New Offerings

Looking ahead, Moniepoint’s expansion strategy includes the launch of MonieWorld, a digital remittance platform designed for the African diaspora residing in the UK and Europe. The company has also made a strategic acquisition of Bancom Europe, which provides it with FCA-regulated UK licenses that are applicable across the European Economic Area. This move is expected to enhance Moniepoint’s access to broader European markets.

Despite incurring a $1.2 million loss related to startup costs in the UK, the management views this investment as a necessary step for long-term growth. Moniepoint is also focusing on developing its London office, laying the groundwork for further international scaling.

As Moniepoint continues to innovate and expand its offerings, it remains committed to addressing the unique financial challenges faced by MSMEs in Africa and beyond. The recent funding will play a crucial role in enhancing its capabilities and ensuring that more businesses can thrive in the evolving financial landscape.

-

Entertainment2 months ago

Entertainment2 months agoIconic 90s TV Show House Hits Market for £1.1 Million

-

Lifestyle4 months ago

Lifestyle4 months agoMilk Bank Urges Mothers to Donate for Premature Babies’ Health

-

Sports3 months ago

Sports3 months agoAlessia Russo Signs Long-Term Deal with Arsenal Ahead of WSL Season

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Flock to Discounted Neck Pillow on Amazon for Travel Comfort

-

Politics4 months ago

Politics4 months agoMuseums Body Critiques EHRC Proposals on Gender Facilities

-

Business4 months ago

Business4 months agoTrump Visits Europe: Business, Politics, or Leisure?

-

Lifestyle4 months ago

Lifestyle4 months agoJapanese Teen Sorato Shimizu Breaks U18 100m Record in 10 Seconds

-

Politics4 months ago

Politics4 months agoCouple Shares Inspiring Love Story Defying Height Stereotypes

-

World4 months ago

World4 months agoAnglian Water Raises Concerns Over Proposed AI Data Centre

-

Sports4 months ago

Sports4 months agoBournemouth Dominates Everton with 3-0 Victory in Premier League Summer Series

-

World4 months ago

World4 months agoWreckage of Missing Russian Passenger Plane Discovered in Flames

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Rave About Roman’s £42 Midi Dress, Calling It ‘Elegant’