Business

Delivery Driver Eyes £10,000 After Landmark Car Finance Ruling

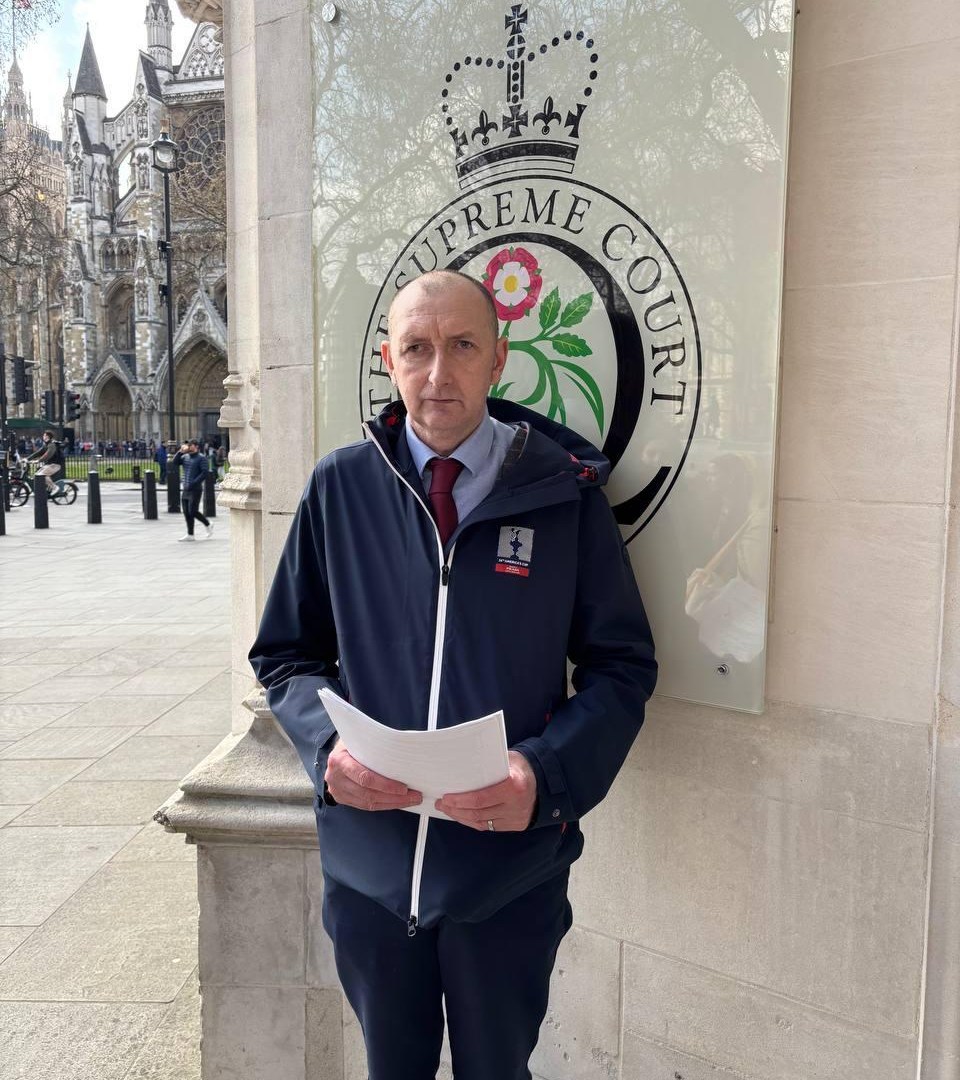

Roy Turner, a pizza delivery worker from Tayport, could potentially receive £10,000 in compensation stemming from ongoing issues related to the car finance scandal. This comes despite a recent landmark ruling by the Supreme Court of the United Kingdom, which favored banks in a significant legal dispute.

Turner, aged 57, purchased a BMW 118D in 2016 to assist his disabled wife, Elaine, with mobility challenges. He is among millions of borrowers still eligible for compensation following revelations that banks may have charged excessive interest rates, from which dealers earned substantial commissions.

The Supreme Court was reviewing an appeal against a October 2022 ruling by the Court of Appeal. This earlier decision highlighted that car dealers profited from sales while also receiving undisclosed commissions for introducing clients to financing options. Such arrangements, referred to as “commission disclosure complaints,” could affect nearly 99% of car finance loans.

In its ruling, the Court of Appeal determined that certain financial firms violated regulations by failing to disclose these hidden commission structures. Banks, specifically FirstRand Bank and Close Brothers, contested this decision, labeling it an “egregious error.”

On October 5, 2023, the Supreme Court overturned the ruling in two cases but preserved the path for compensation in specific circumstances. It upheld a prior judgement regarding a case involving a borrower, Mr. Johnson, where excessive interest was charged. While the court ruled that banks are not responsible for undisclosed commissions, they remain accountable for discretionary commission arrangements, which affect approximately 40% of car finance deals.

The Financial Conduct Authority (FCA) is currently evaluating a financial redress scheme for drivers impacted by personal contract purchases (PCP) and hire purchase agreements that were issued prior to January 28, 2021. This investigation seeks to address situations where brokers and dealers could inflate interest rates without informing customers, thereby increasing their commission.

Payouts from this scandal could have reached as high as £44 billion had the Court of Appeal’s decision been upheld. Following the Supreme Court’s ruling, estimates suggest total payouts may now be around £20 billion. This outcome represents a significant victory for the banking sector, while many affected drivers may feel disappointed.

Turner’s specific case involves a discretionary commission arrangement, making him eligible for compensation. He expressed his concerns about the financial system, stating, “These companies have been robbing the poor to benefit the rich. I’m devastated for others.”

Turner acquired his vehicle for £8,650, but the total credit cost reached an astonishing £9,356, resulting in an overall expenditure of £17,996. He recounted that the dealer, John Clark Aberdeen, failed to perform an affordability check, despite his poor credit rating. With a monthly repayment of £157 and an alarming interest rate of 39.1% APR over five years, Turner struggled to manage his expenses.

Reflecting on his experience, he noted the stress of the financial burden. “I was struggling to afford phone bills. If the car needed repair work or an MOT, I would need to borrow money from friends. It was very embarrassing. I wish I never took it out because of the interest rate,” he said.

After learning about the mis-selling scandal through a television advertisement, Turner contacted Courmac Legal, which has initiated a claim on his behalf. The firm estimates that his claim could reach as high as £10,000. “I feel disgusted. I was completely misled by the dealer and lender when I took out a loan to buy my car. The financial impact on my family of the hidden commission was considerable,” he emphasized.

Local MP Wendy Chamberlain expressed her shock at Turner’s situation, asserting that “loans must be transparent practices, not riddled with hidden commissions for those who sell them at the expense of honest people’s hard-earned money.”

While the specifics of who can claim compensation have not yet been finalized, it is anticipated that anyone who acquired a car, van, or motorcycle under PCP or hire purchase agreements prior to the end of January 2021 may be entitled to thousands in refunds. A recent poll by consumer law firm Slater and Gordon suggests that over 23 million people could potentially qualify for compensation, reflecting a widespread issue across the market.

The FCA is expected to announce its plans for a compensation scheme within six weeks of the Supreme Court ruling, potentially implementing automatic refunds for affected customers. However, claims for agreements made before April 6, 2007 may not be eligible, as the Financial Ombudsman took over motor finance complaints after that date.

While waiting for the FCA’s announcement, individuals who believe they may be owed compensation are encouraged to file claims. Consumer finance website MoneySavingExpert.com offers a free template for those wishing to lodge complaints with their finance providers. If a complaint is not resolved satisfactorily, individuals can escalate the matter to the Financial Ombudsman Service without charge.

Affected individuals have until July 29, 2026, or up to 15 months from the date of their finance provider’s final response, to submit their claims.

As the fallout from this scandal continues, individuals like Paul Carlier, who was pivotal in exposing the financial mis-selling, remain determined to seek justice for those impacted. Carlier, who first uncovered these issues in 2016, stated, “It’s not over – this won’t end here. With the evidence we’ve got, we will bring new claims and class actions on behalf of the victims who have today been denied justice.”

-

Entertainment2 months ago

Entertainment2 months agoIconic 90s TV Show House Hits Market for £1.1 Million

-

Lifestyle4 months ago

Lifestyle4 months agoMilk Bank Urges Mothers to Donate for Premature Babies’ Health

-

Sports3 months ago

Sports3 months agoAlessia Russo Signs Long-Term Deal with Arsenal Ahead of WSL Season

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Flock to Discounted Neck Pillow on Amazon for Travel Comfort

-

Politics4 months ago

Politics4 months agoMuseums Body Critiques EHRC Proposals on Gender Facilities

-

Business4 months ago

Business4 months agoTrump Visits Europe: Business, Politics, or Leisure?

-

Lifestyle4 months ago

Lifestyle4 months agoJapanese Teen Sorato Shimizu Breaks U18 100m Record in 10 Seconds

-

Politics4 months ago

Politics4 months agoCouple Shares Inspiring Love Story Defying Height Stereotypes

-

World4 months ago

World4 months agoAnglian Water Raises Concerns Over Proposed AI Data Centre

-

Sports4 months ago

Sports4 months agoBournemouth Dominates Everton with 3-0 Victory in Premier League Summer Series

-

World4 months ago

World4 months agoWreckage of Missing Russian Passenger Plane Discovered in Flames

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Rave About Roman’s £42 Midi Dress, Calling It ‘Elegant’