Business

Raspberry Pi Shares Drop as Profits Plummet by 43%

Shares in Raspberry Pi experienced a significant decline on Tuesday in London after the low-cost computer manufacturer reported a steep fall in half-year profits. The Cambridge-based company, which made headlines with its initial public offering (IPO) in June 2024, announced a 43 percent drop in pre-tax profit, now standing at $6.2 million (£4.6 million) for the six months ending in June. Revenue also decreased by nearly six percent to $135.5 million (£100 million), while adjusted earnings fell by seven percent to $19.4 million (£14.3 million).

As a result of these disappointing results, shares fell by as much as five percent to 382p, marking a substantial 42 percent decrease year-to-date. While the stock remains above its IPO price of 280p, it is significantly below the peak of 780p reached in January.

Investor Concerns Grow Amid Falling Profits

Chief executive Eben Upton emphasized that the second half of the year had begun positively and maintained that guidance for full-year profits remains unchanged. He stated, “We continued to build momentum in the half, with growing demand from our reseller channel and OEMs driving an eight percent sequential increase in direct unit shipments and a significant customer order backlog at the end of June.”

Upton highlighted the launch of seven new products in the first half and noted a surge in demand for microcontrollers, with semiconductor volumes surpassing board sales for the first time. Despite this, analysts expressed concern over the company’s performance and the potential for continued share price declines.

Russ Mould, investment director at AJ Bell, remarked, “It feels like quite a lot is riding on Raspberry Pi, which represented the most meaningful tech IPO in the UK in years.” He added that many investors would likely be disappointed by the latest results and the corresponding drop in revenue and profit.

Concerns also linger regarding the potential impact of tariffs on components, an issue Upton has attempted to downplay. Additionally, research and development costs surged by nearly 40 percent during the half-year period.

A Test Case for UK Tech Investments

Dan Lane, UK lead analyst at Robinhood, noted that while the market still supports Raspberry Pi, expectations have risen significantly. “Flat volumes and a huge fall in profits don’t paint the greatest picture for one of the UK’s most notable tech hopes,” he stated. He acknowledged, however, that the second half of the year could yield better profits, as the company has enough resources to meet sales targets.

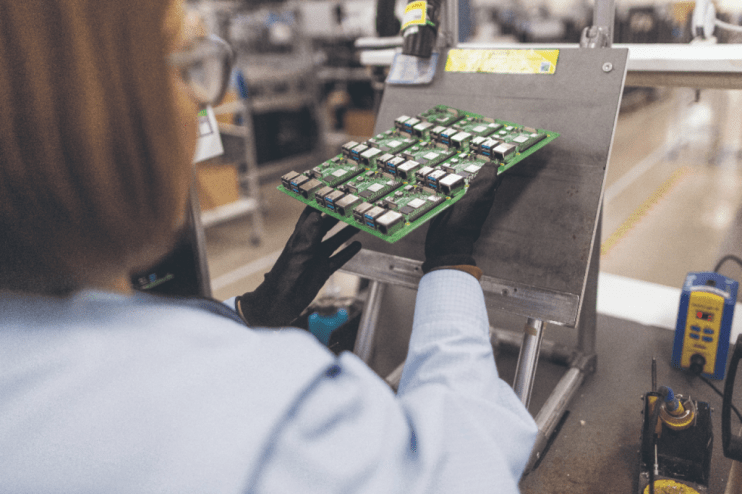

Founded in 2012 with the mission to make computing accessible, Raspberry Pi has sold tens of millions of its single-board computers globally, serving various sectors from education to industrial applications. Its IPO last year, valued at £542 million, was seen as a rare success for the London Stock Exchange at a time when many tech firms prefer listings in New York.

With profits under pressure and shares sliding, Raspberry Pi is becoming a crucial indicator of how UK investors view small and mid-cap tech companies. Mould cautioned that while the company is still relatively young, investors should not expect profits to rise in a straightforward manner. He concluded, “Nonetheless, any further disappointments may find that patience is running thin on the ground.”

-

Entertainment2 months ago

Entertainment2 months agoIconic 90s TV Show House Hits Market for £1.1 Million

-

Lifestyle4 months ago

Lifestyle4 months agoMilk Bank Urges Mothers to Donate for Premature Babies’ Health

-

Sports3 months ago

Sports3 months agoAlessia Russo Signs Long-Term Deal with Arsenal Ahead of WSL Season

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Flock to Discounted Neck Pillow on Amazon for Travel Comfort

-

Politics4 months ago

Politics4 months agoMuseums Body Critiques EHRC Proposals on Gender Facilities

-

Business4 months ago

Business4 months agoTrump Visits Europe: Business, Politics, or Leisure?

-

Lifestyle4 months ago

Lifestyle4 months agoJapanese Teen Sorato Shimizu Breaks U18 100m Record in 10 Seconds

-

Politics4 months ago

Politics4 months agoCouple Shares Inspiring Love Story Defying Height Stereotypes

-

World4 months ago

World4 months agoAnglian Water Raises Concerns Over Proposed AI Data Centre

-

Sports4 months ago

Sports4 months agoBournemouth Dominates Everton with 3-0 Victory in Premier League Summer Series

-

World4 months ago

World4 months agoWreckage of Missing Russian Passenger Plane Discovered in Flames

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Rave About Roman’s £42 Midi Dress, Calling It ‘Elegant’