Business

HMRC Announces Major Tax Reporting Changes by April 2026

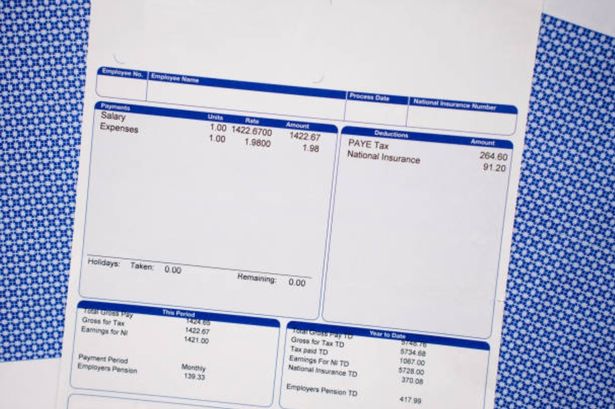

The UK’s tax reporting system is undergoing significant changes as the HM Revenue and Customs (HMRC) has announced that households have only six months left to prepare for the implementation of the Making Tax Digital for Income Tax initiative. Starting in April 2026, this new system will alter the way self-employed individuals and property owners report their income and expenses.

In a recent post on the social media platform X, HMRC highlighted the urgency of the upcoming transition. The message stated, “There’s just 6 months to go until Making Tax Digital for Income Tax. From April 2026, there will be a new way to report income from self-employment and property to us.” Households are encouraged to evaluate their readiness and determine whether they need to enroll for the next tax year.

Understanding the New Reporting Process

Under the new regime, taxpayers will need to submit quarterly updates summarizing their income and expenses. HMRC clarified that these updates are intended to be straightforward. “They’re just simple summaries of how your business is doing, in four smaller chunks, pulled from your records,” the agency explained. If individuals maintain their records consistently, they will be able to provide these quarterly updates with minimal effort.

This approach aims to simplify the tax filing process. After each quarterly update, taxpayers will receive an estimate of their tax liability, allowing them to plan accordingly. HMRC assured that software solutions will be available to compile these quarterly updates into an end-of-year tax summary, minimizing the need for extensive form-filling.

While the new system represents a significant shift in tax reporting, HMRC emphasized that it will not alter payment schedules or methods for Income Tax. Taxpayers will continue to pay their taxes as they currently do, but the process of reporting will be streamlined.

Implications for Taxpayers

The introduction of Making Tax Digital for Income Tax is part of the UK government’s broader initiative to modernize the tax system and address the tax gap—the disparity between taxes owed and taxes paid. Furthermore, HMRC specified that partnerships will not be required to use this new system and can continue with the traditional Self Assessment tax return process.

Individuals earning income from self-employment or property outside of a partnership must adhere to the new requirements if their turnover meets the designated thresholds.

Taxpayers are encouraged to familiarize themselves with the changes and assess whether they need to sign up for the new service. As the deadline approaches, HMRC remains committed to providing resources and guidance to ensure a smooth transition for UK households.

-

Entertainment2 months ago

Entertainment2 months agoIconic 90s TV Show House Hits Market for £1.1 Million

-

Lifestyle4 months ago

Lifestyle4 months agoMilk Bank Urges Mothers to Donate for Premature Babies’ Health

-

Sports3 months ago

Sports3 months agoAlessia Russo Signs Long-Term Deal with Arsenal Ahead of WSL Season

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Flock to Discounted Neck Pillow on Amazon for Travel Comfort

-

Politics4 months ago

Politics4 months agoMuseums Body Critiques EHRC Proposals on Gender Facilities

-

Business4 months ago

Business4 months agoTrump Visits Europe: Business, Politics, or Leisure?

-

Lifestyle4 months ago

Lifestyle4 months agoJapanese Teen Sorato Shimizu Breaks U18 100m Record in 10 Seconds

-

Politics4 months ago

Politics4 months agoCouple Shares Inspiring Love Story Defying Height Stereotypes

-

World4 months ago

World4 months agoAnglian Water Raises Concerns Over Proposed AI Data Centre

-

Sports4 months ago

Sports4 months agoBournemouth Dominates Everton with 3-0 Victory in Premier League Summer Series

-

World4 months ago

World4 months agoWreckage of Missing Russian Passenger Plane Discovered in Flames

-

Lifestyle4 months ago

Lifestyle4 months agoShoppers Rave About Roman’s £42 Midi Dress, Calling It ‘Elegant’